In recent years, emissions trading systems and carbon credits have attracted attention, and the development of these systems is progressing in Japan as well. This article explains their overview, impact, and future outlook.

What is an Emissions Trading System?

An emissions trading system is a market mechanism designed to reduce greenhouse gas emissions. Emission quotas are set for each country or company, and by trading within these quotas, total emissions are controlled.

Such systems have been introduced in many countries, and full-scale implementation is also under consideration in Japan.

Overview of the Emissions Trading System:

Under an emissions trading system, companies or countries emit greenhouse gases within their allocated quotas, and if they exceed these quotas, they purchase allowances from others.

There are two main types: “cap-and-trade” and “baseline-and-credit.” The former is adopted by the EU and many other countries. In Japan, Tokyo and Saitama Prefecture have implemented regional trading systems, but the government is now moving toward a nationwide system (GX-ETS).

This is positioned as a key policy for achieving carbon neutrality by 2050.

What are Carbon Credits?

Carbon credits quantify greenhouse gas reductions in a tradable form. Credits obtained through emission reduction activities by companies or organizations can be purchased by entities with reduction obligations or those wishing to strengthen environmental measures.

This section explains the trends in the domestic market and differences with the JCM.

Trends in the Domestic Market:

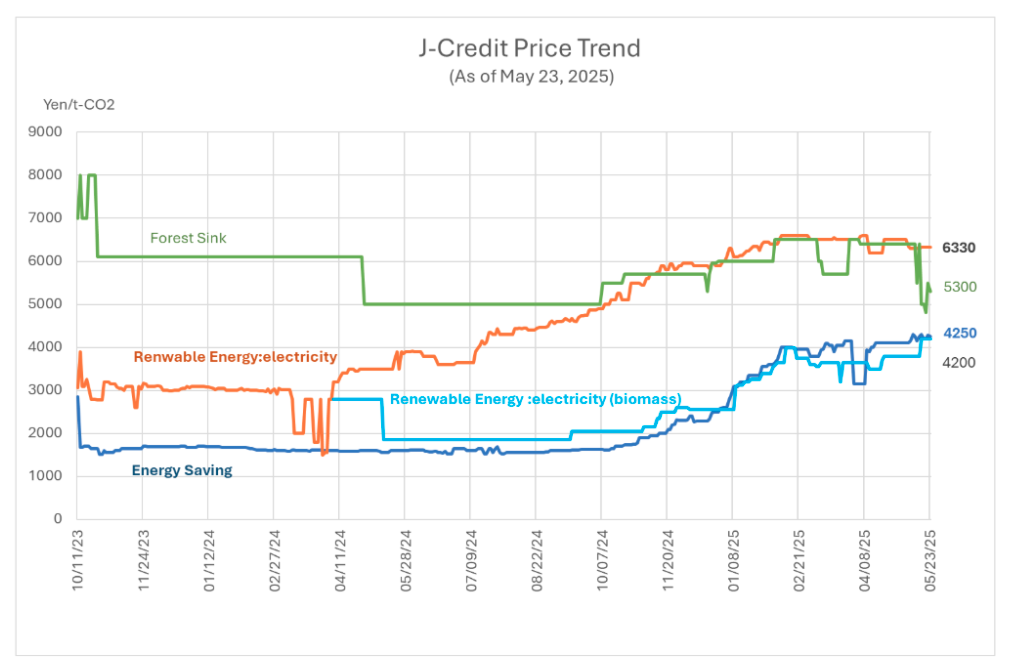

Japan’s carbon credit market has grown rapidly in recent years. In particular, the government-promoted “J-Credit Scheme” has developed into a system used by many companies and municipalities.

CO₂ reductions achieved through energy-saving measures, renewable energy adoption, and forest conservation are certified as credits and traded among companies.

Additionally, voluntary purchases of carbon credits, especially by major companies, are increasing and play an important role in corporate decarbonization strategies. As part of the government’s GX (Green Transformation) policy, further market activation is expected.

Differences among J-Credits, Voluntary Credits, and International Credits (JCM):

There are several types of carbon credits, each with different characteristics:

- J-Credits: A government-certified scheme in Japan that issues credits for CO₂ reductions achieved through energy-saving or renewable energy adoption. It is characterized by easy participation for domestic companies and municipalities.

- Voluntary Credits: Credits managed by the private sector, used by companies for voluntary carbon offsetting. Examples include VCS (Verified Carbon Standard) and Gold Standard, which are certified to international standards and can be used in global markets.

- International Credits (JCM: Joint Crediting Mechanism): A scheme where Japan and developing countries jointly implement projects to reduce greenhouse gas emissions, sharing the results between both countries. Japanese companies can provide technology and support emission reductions in partner countries to earn credits.

Although these systems are operated for different purposes, they all promote CO₂ reduction and contribute to a sustainable society. The use of these systems is expected to further accelerate Japan’s decarbonization policies.

Relation to the GX League:

The GX (Green Transformation) League is a framework promoted by the Japanese government to support the transition to a decarbonized economy. As companies advance emission reduction efforts, they are closely linked to the emissions trading system and carbon credit market.

Companies participating in the GX League are expected to use credits to achieve reduction targets and enhance international competitiveness.

To achieve the government’s goal of carbon neutrality by 2050, collaboration among companies and proper circulation of credits are emphasized. The evolution of emission reduction frameworks through the GX League is drawing attention.

Impact and Countermeasures for Consumers:

The expansion of emissions trading systems and the carbon credit market significantly affects consumers. Especially in energy-intensive industries such as manufacturing and logistics, rising carbon costs are inevitable, and concrete measures to adapt to the emissions trading system are required.

Effective measures include introducing energy-saving technologies and utilizing renewable energy. For example, optimizing energy management in factories and offices to reduce emissions leads to long-term cost savings. Purchasing carbon credits to effectively offset emissions is also important.

As decarbonization progresses throughout supply chains, more cases are emerging where business partners are required to disclose CO₂ emissions. To respond, accurate measurement, reporting, and verification (MRV) of emissions and visualization of environmental impacts are essential.

Companies proactive in emission reduction will be more highly evaluated in the market, while those slow to respond may lose competitiveness, so early action is necessary.

Future Outlook:

Emissions trading systems and the carbon credit market will become increasingly important. As the government accelerates its carbon neutrality policy, systems to support emission reductions by companies and municipalities will be strengthened.

Future Schedule:

As of March 2025, emissions trading systems and the carbon credit market are transitioning from the initial stage of operation to the next phase. Based on government policy and international trends, further expansion and system development are expected.

In FY2024, the Japanese government began full-scale operation of the emissions trading system under the “Basic Policy for the Realization of GX.” At this stage, many companies have set greenhouse gas emission reduction targets, and the credit trading market is becoming more active.

In FY2027, the emissions trading market (GX-ETS) is scheduled to open and begin full-scale operation. Mandatory participation and full-scale operation of emissions trading will begin for large companies emitting over 100,000 tons of CO₂ annually.

To achieve the government’s targets of a 46% reduction by FY2030 (compared to FY2013) and a 73% reduction by FY2040, strengthening regulations on emissions trading systems and expanding incentives in the carbon credit market are expected.

During this process, issues such as rising credit prices and ensuring market transparency will need to be addressed. In fact, the price of J-Credits has doubled in recent years.

Ultimately, these systems will be essential pillars of corporate decarbonization strategies in achieving carbon neutrality by 2050. As the pace of change accelerates, companies must accurately grasp system trends and take early action to secure future competitiveness.

Toward Carbon Neutrality:

Japan’s emissions trading system and carbon credit market play a vital role in realizing carbon neutrality.

The emissions trading system encourages companies to reduce greenhouse gas emissions, and the carbon credit market facilitates credit trading through reduction projects. J-Credits, JCM, and voluntary credits are utilized, and collaboration with the GX League is also progressing.

The market is expected to expand, and companies are required to manage emissions while utilizing these systems. New system introductions and international market linkages are anticipated, making efforts toward achieving carbon neutrality by 2050 increasingly important.