Customer

An auto parts manufacturing company with 5 factory locations and 1 office building. The company is publicly listed.

Past Procurement Method

Bought all power requirements from each local utility. Paid a tariff price with a monthly fuel cost adjustment.

Problem

Electricity costs were about 8% of the manufacturing costs. The company sold its auto parts to automobile manufacturers on a fixed price basis for a large quantity of parts over a year period. The utility electricity prices varied each month, and this made the company’s costs also vary, so that forecasting profits on sales was challenging, which also affected the company’s stock price.

Planning

The auto parts company did not have the internal skills to understand its procurement options and negotiate with utilities and suppliers. The company retained an energy procurement broker to assist them. (a company like Ene Buyer)

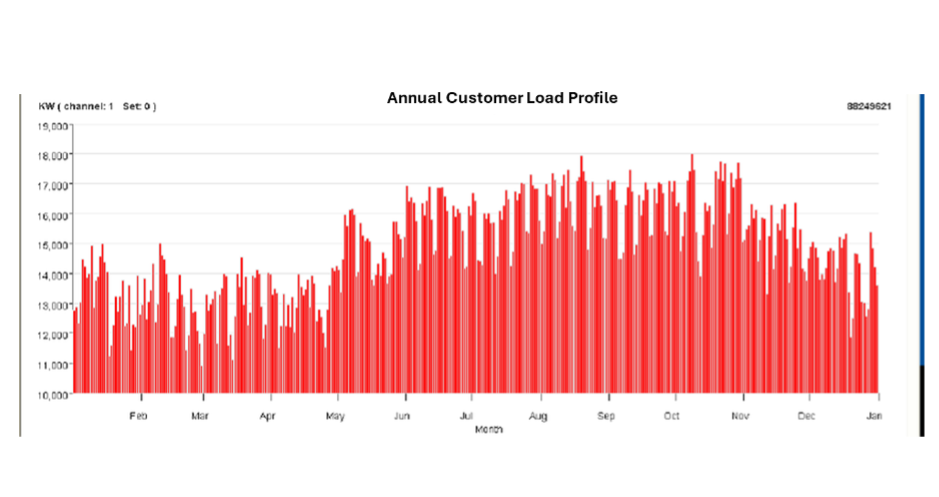

The company provided the broker with meter data history and utility billing information. The broker did analysis and developed procurement options for the company to review. Those options included:

- Continue to purchase from the utilities with a monthly fuel cost adjustment price plan.

a.A “do nothing different” strategy. - Seek a one-, two-, or three-year fixed price for its entire demand by submitting an RFP to multiple suppliers, including the utilities the company currently buys from.

a.Supplier bids were for electricity only. The utility delivery charges are already fixed by tariff, so those would remain the same no matter which option is selected. - Seek a one-, two-, or three-year fixed price for a base demand and a monthly variable method for fluctuating demand over the base by submitting an RFP to multiple suppliers, including the utilities the company currently buys from.

a.Supplier bids were for electricity only. The utility delivery charges are already fixed by tariff, so those would remain the same no matter which option is selected. - The broker also did due diligence on the supplier options to eb

The broker first evaluated different suppliers based on criteria such as,

- A substantial balance sheet and solid reputation.

- Checked with the regulator for customer complaints.

- Assured the supplier was a member of the spot and futures markets.

If not a member of both markets, the supplier would not be suitable to propose fixed price plans.

Once the broker developed a short list of suitable suppliers, they submitted the company information and load profile with a request for suppliers to bid on one or all three of the options shown above.

Results

The utilities all submitted proposals for Option 1, fuel cost adjustment, with a different formula for each location. They also submitted proposals to convert from the fuel cost adjustment method to a fully variable price based on the spot market price each 30 minutes of every day. (This option was not requested as it provides even less price risk protection.)

Three non-utility suppliers submitted bids based on Option 2 and Option 3. These bids provided a single commodity price for all the companies locations.

The broker compiled all the RFP results and performed an options analysis for the company so they could easily assess the difference in offers and the risks of each option.

The company chose to go with Option 2, a fixed price for their entire load for a two-year period. They selected this option instead of the partial fixed, partial variable Option 3 as it provided a better method of internal budgeting and cost management. A secondary reason is the company needs to start reducing its carbon footprint to comply with their customers’ sustainability requirements, which will need to be solved within 3 years.

The broker then worked with the selected supplier on behalf of the customer to negotiate the supply contract. The broker also oversaw the supply switching process from the utility supplier to the new supplier.

Next Steps

Once the fixed price supplier was successfully set up, the broker started helping the company plan for procuring renewable power on a PPA basis.